Why Bitcoiners Bought the Bottom When Normies Couldn't

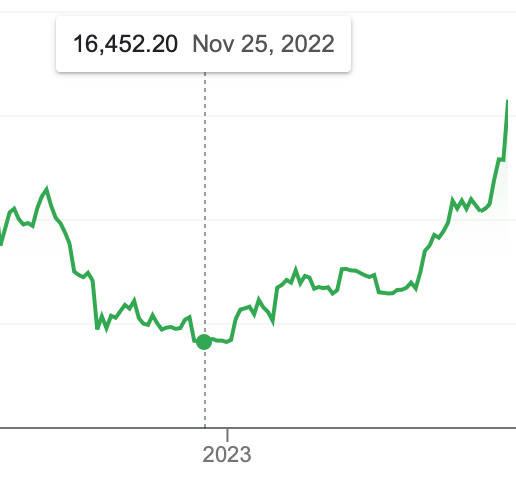

Just over a year ago Bitcoin was ranging between 16 and 17 thousand dollars before beginning its trend upward.

First to $20k. Then $25k. Then 30k. Then 40k. Then 50k. Now, over 60k.

There was volatility along the way but if you zoom out, you see a direct path going up.

But this upward surge didn’t occur overnight.

It took over a year.

To the Bitcoiner, this was okay. The Bitcoiner has enough knowledge and understanding to act on a lower price point to buy more Bitcoin than would normally be possible if it were at higher prices. The Bitcoiner doesn’t run away or get scared when pullbacks happen, they buy more Bitcoin. The Bitcoiner is able to lower their time preference to think in years, even decades, instead of worrying about the day-to-day price point. The Bitcoiner knows what they are buying, why they are buying, and can picture a future outcome for holding what they are buying.

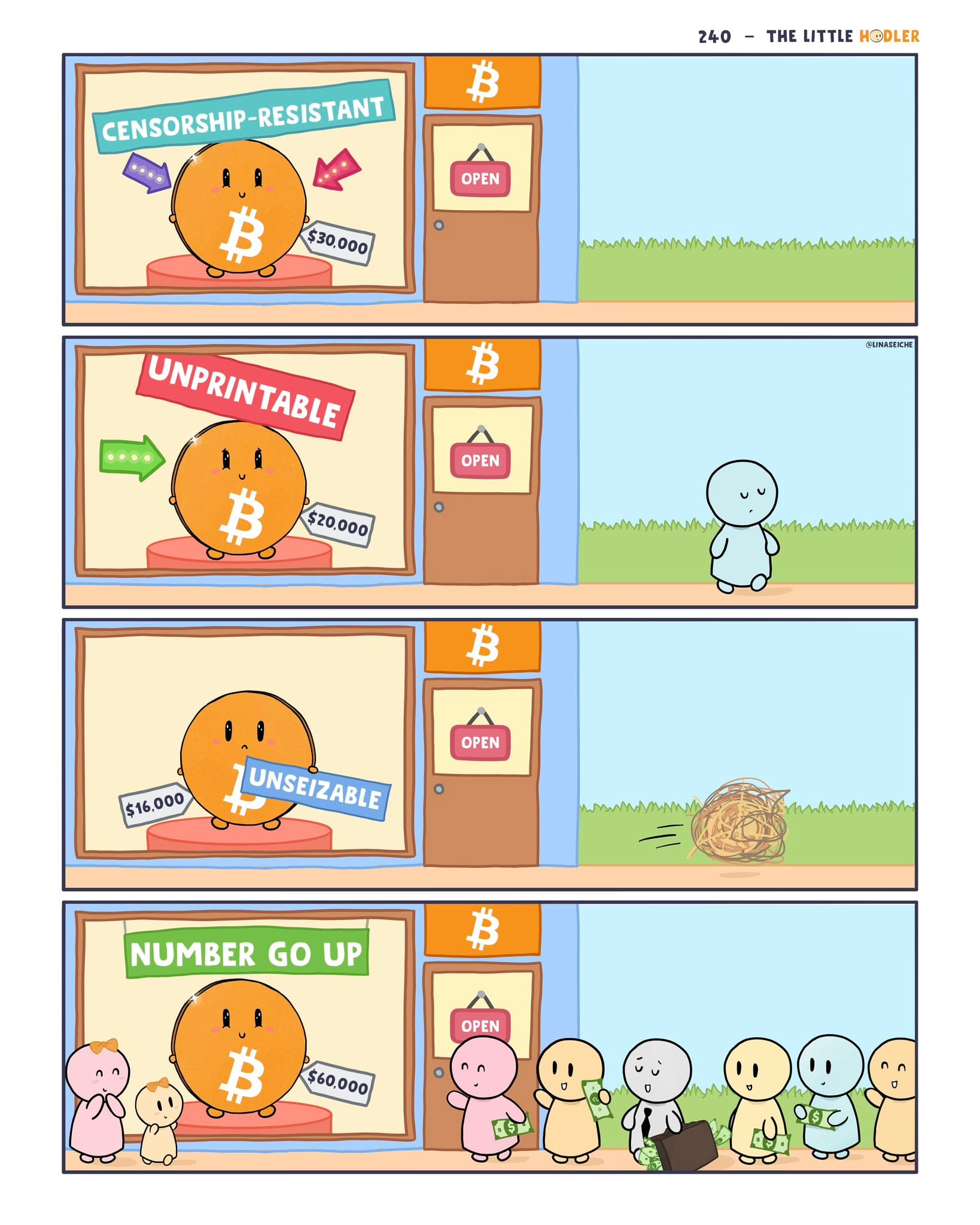

To everyone else in the world, it was like Bitcoin no longer existed. It was the toy that got thrown away when the new edition appeared. It was the used car sitting on the lot with no one interested.

Why was this the case?

Why wasn’t everyone viewing a lower price of Bitcoin as an opportunity?

Why did they wait until Bitcoin approached an all-time high to have any interest in allocating a portion of their investment strategy?

The answer is human psychology.

Human psychology gets in the way of the unchanging and eternal laws of math and physics that Bitcoin relies on. Human emotions prevent action. The “human” side of things cloud the path to Bitcoin.

For many, it is nearly impossible to invest in something that has gone down 60% from its previous all-time high. When people think of investments they think of equity stocks. When you see a 60% decrease in price for a stock, you assume that the company is a failing company. This anchoring bias to the equity market prevented many from acting and purchasing Bitcoin when it trended downward. People don't want to hold a “sinking ship.”

Previous thoughts, headlines, opinions, and surface-level claims confused people when Bitcoin was trending downward. They thought it was “worthless.” They thought it was “dying.” They thought it was “going to zero.” They held these opinions because that was the public narrative around Bitcoin. People wanted to believe they hadn’t missed an opportunity and were instead right about the fact that Bitcoin was “failing.” They felt vindicated when it went down in price. People don’t want to be wrong.

Greed and other emotions made people unable to act. When the price was $16k they were told, and believed it would only go lower. Then and only then would they buy. People wanted to time the market exactly right and in this desire, in this greed, their hands were tied.

Human psychology tells you when it is priced at a discount it’s worthless but when it’s priced at a premium that is only increasing, you need to buy so you don’t miss out.

Now, with the price of Bitcoin reaching levels near an all-time high it is once again becoming the shiny new toy people want to play with. Conversations about Bitcoin are beginning to fill social media timelines and will only become louder as the price goes up. People will go from being excited to euphoric when discussing the possibility of where the price of Bitcoin can go. People care because once again, “number go up.”

The only way I have found to take emotion out of the equation while also minimizing the effects of the human psyche surrounding your thoughts on Bitcoin is to learn.

- Books

- Podcasts

- YouTube videos

- Articles

- More books

- More Podcasts

- More YouTube videos

- More Articles

LEARN

Spending time to learn and understand the economics behind Bitcoin will grant you the conviction needed to operate with Bitcoin in an emotionless way. When the price goes up you buy. When the price stays the same you buy. When the price goes down you buy. You know what you hold so you know what you must continue to buy.

Bitcoin as an asset is no different today than Bitcoin one year ago. It is the same code set to run forever, needing no significant upgrade. It is still inflation and censorship-resistant. The only difference is the ratio of the US dollar to Bitcoin. When fewer dollars were needed for one Bitcoin, people didn’t care. Now, and in the future, as more dollars are required for one Bitcoin, the world will continue to care. In the long run, everything devalues against Bitcoin.

Keep stacking SATs.

The views and opinions expressed here are for entertainment purposes only and should, in no way, be interpreted as financial or investment advice. Always conduct your own research when making an investment or trading decision, as each such move involves risk. The team members behind Triana are not financial advisors and do not claim to be qualified to convey information or advice that a registered financial advisor would convey to clients as guidance. Nothing contained in this e-mail/article constitutes, or shall be construed as, an offering of financial instruments, investment advice, or recommendations of an investment strategy. If you are seeking financial advice, find a professional who is right for you.